When To Use Audit Reconsideration for IRS Debt

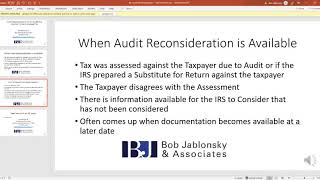

Audit Reconsideration is one tool to use when the IRS has assessed income tax against a taxpayer and the taxpayer believes that they do not owe the debt. Typically it occurs when the taxpayer is audited or when the IRS prepares a Substitute Return on behalf of the taxpayer.

Audit Reconsideration is one tool to use when the IRS has assessed income tax against a taxpayer and the taxpayer believes that they do not owe the debt. Typically it occurs when the taxpayer is audited or when the IRS prepares a Substitute Return on behalf of the taxpayer.