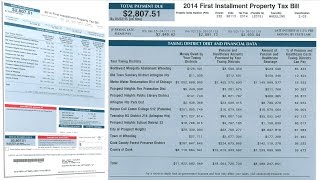

A tutorial that explains how to read the 2014 First Installment of the Cook County property tax bill that contains debt figures for every local government that taxes a home, business or other real estate property. Treasurer Maria Pappas feels strongly that people have a right to know where their tax money is going, and showing them the debt of the governments closest to them, local governments, “is transparency in its highest form.”

Pappas explained that the information comes from the Debt Disclosure Ordinance (DDO), which requires all primary local governments across Cook County to report their financial data yearly to the Treasurer's Office. Pappas also put the DDO data on cookcountytreasurer.com, where taxpayers can look deeper into the finances of the individual taxing districts that claim shares of their tax bill.

The information listed is:

•Money Owed by Your Taxing Districts

•Pension and Healthcare Amounts Promised by Your Taxing Districts

•Amount of Pension and Healthcare Shortage

•Percentage of Pension and Healthcare Costs Taxing Districts Can Pay

A tutorial that explains how to read the 2014 First Installment of the Cook County property tax bill that contains debt figures for every local government that taxes a home, business or other real estate property. Treasurer Maria Pappas feels strongly that people have a right to know where their tax money is going, and showing them the debt of the governments closest to them, local governments, “is transparency in its highest form.”

Pappas explained that the information comes from the Debt Disclosure Ordinance (DDO), which requires all primary local governments across Cook County to report their financial data yearly to the Treasurer's Office. Pappas also put the DDO data on cookcountytreasurer.com, where taxpayers can look deeper into the finances of the individual taxing districts that claim shares of their tax bill.

The information listed is:

•Money Owed by Your Taxing Districts

•Pension and Healthcare Amounts Promised by Your Taxing Districts

•Amount of Pension and Healthcare Shortage

•Percentage of Pension and Healthcare Costs Taxing Districts Can Pay

Understanding Your Property Tax bill to track local government debt

Understanding Your Property Tax bill to track local government debt

Category :

Tax Debt