#financialmodeling #projectfinance #renewableenergyThis is a lesson from the financial modeling course "Project Finance Modeling for Renewable Energy"Click below link to check out our existing courses:https://www.financialmodelonline.com/p/project-finance-modeling-for-renewable-energyProject Finance Modelling for Renewable Energy course will teach you everything you need to know about financial modeling for wind and solar projects.In The Project Finance Modeling course, we will model complex greenfield toll road project finance transactions from scratch in excel.You will learn about:-How to build a project finance model from scratch in excel for wind and solar projects;

-Learn how renewable energy projects get developed and financed;

-How to create best practice macro’s and Excel VBA codes to break circularities;

-Learn how to size debt based on multiple covenants for wind and solar projects;

-How to model Debt Service Reserve Account;

-How to model unlevered project returns and blended equity returns;

-Learn to integrate multiple probability exceedance generation profiles (P50, P99) into the financial model;

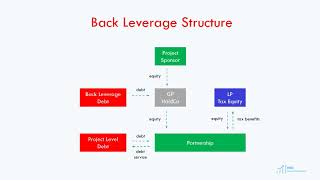

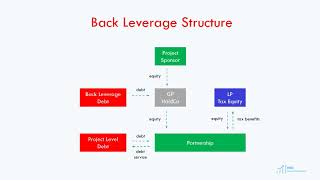

-Learn basics of GP/LP flip structures and tax equity for project financing;

-Gain insights into financial model development process, step-by-step – for a renewable energy model;

-Optimize the model to achieve the requirements of lenders and investors.This is the same comprehensive financial training used to prepare analysts and managers at top financial institutions and infrastructure funds.FMO specializes in developing your financial modeling skills in project finance, investment banking, asset, and wealth management. While we are a young firm, the team has decades of experience of complex financial transaction modeling.

#financialmodeling #projectfinance #renewableenergyThis is a lesson from the financial modeling course "Project Finance Modeling for Renewable Energy"Click below link to check out our existing courses:https://www.financialmodelonline.com/p/project-finance-modeling-for-renewable-energyProject Finance Modelling for Renewable Energy course will teach you everything you need to know about financial modeling for wind and solar projects.In The Project Finance Modeling course, we will model complex greenfield toll road project finance transactions from scratch in excel.You will learn about:-How to build a project finance model from scratch in excel for wind and solar projects;

-Learn how renewable energy projects get developed and financed;

-How to create best practice macro’s and Excel VBA codes to break circularities;

-Learn how to size debt based on multiple covenants for wind and solar projects;

-How to model Debt Service Reserve Account;

-How to model unlevered project returns and blended equity returns;

-Learn to integrate multiple probability exceedance generation profiles (P50, P99) into the financial model;

-Learn basics of GP/LP flip structures and tax equity for project financing;

-Gain insights into financial model development process, step-by-step – for a renewable energy model;

-Optimize the model to achieve the requirements of lenders and investors.This is the same comprehensive financial training used to prepare analysts and managers at top financial institutions and infrastructure funds.FMO specializes in developing your financial modeling skills in project finance, investment banking, asset, and wealth management. While we are a young firm, the team has decades of experience of complex financial transaction modeling.

Tax Equity Flip and Back Leverage Debt in US Renewable Energy Sector

Tax Equity Flip and Back Leverage Debt in US Renewable Energy Sector

Category :

Tax Debt