In today’s video, we learn about calculating the cost of debt used in the weighted average cost of capital (WACC) calculation. This is part of the DCF insights series for more advanced students but it offers valuable insights about the assumptions used in the model. Like many other segments of the discounted cash flow (DCF) model, the cost of debt is very important. The four methods covered in the video are;

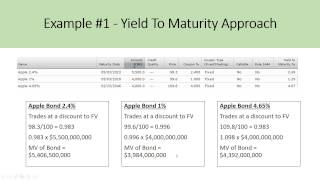

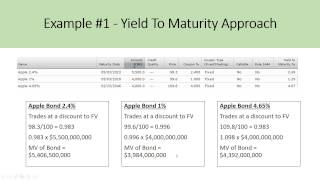

- Yield to maturity (YTM) approach

- Debt rating approach

- Synthetic Rating Approach

- Interest on Debt Approach

Link to the country default spread and risk premium database;

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html

Link to the bond profile for Apple Inc used in the video;

http://quicktake.morningstar.com/stocknet/bonds.aspx?symbol=aapl&country=arg

Link to an amazing presentation summarizing the DCF Model by Aswath Damodaran;

http://people.stern.nyu.edu/adamodar/pdfiles/eqnotes/basics.pdf

Please like and subscribe to my channel for more content every week. If you have any questions, please comment below.

For those who may be interested in finance and investing, I suggest you check out my Seeking Alpha profile where I write about the market and different investment opportunities. I conduct a full analysis on companies and countries while also commenting on relevant news stories.

http://seekingalpha.com/author/robert-bezede/articles#regular_articles

In today’s video, we learn about calculating the cost of debt used in the weighted average cost of capital (WACC) calculation. This is part of the DCF insights series for more advanced students but it offers valuable insights about the assumptions used in the model. Like many other segments of the discounted cash flow (DCF) model, the cost of debt is very important. The four methods covered in the video are;

- Yield to maturity (YTM) approach

- Debt rating approach

- Synthetic Rating Approach

- Interest on Debt Approach

Link to the country default spread and risk premium database;

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html

Link to the bond profile for Apple Inc used in the video;

http://quicktake.morningstar.com/stocknet/bonds.aspx?symbol=aapl&country=arg

Link to an amazing presentation summarizing the DCF Model by Aswath Damodaran;

http://people.stern.nyu.edu/adamodar/pdfiles/eqnotes/basics.pdf

Please like and subscribe to my channel for more content every week. If you have any questions, please comment below.

For those who may be interested in finance and investing, I suggest you check out my Seeking Alpha profile where I write about the market and different investment opportunities. I conduct a full analysis on companies and countries while also commenting on relevant news stories.

http://seekingalpha.com/author/robert-bezede/articles#regular_articles

Estimating The Cost Of Debt For WACC – DCF Model Insights

Estimating The Cost Of Debt For WACC - DCF Model Insights

Category :

Tax Debt