After Tax Cost of Debt - What is the definition and formula - How to calculate

http://www.subjectmoney.com

http://www.subjectmoney.com/definitiondisplay.php?word=After-Tax%20Cost-of-Debt

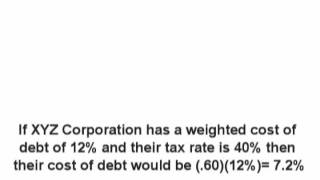

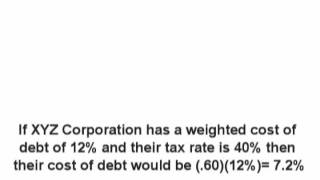

The cost of debt is the effective rate of a company's current debt. Taking taxes into consideration the cost of debt could be much less due to interest payments being tax deductible. The cost of debt after factoring in the tax benefits is called the after-tax cost-of-debt.

https://www.youtube.com/user/Subjectmoney

https://www.youtube.com/watch?v=a7OQE-Oam_M

http://www.subjectmoney.com

http://www.subjectmoney.com/definitiondisplay.php?word=After-Tax%20Cost-of-Debt

The cost of debt is the effective rate of a company's current debt. Taking taxes into consideration the cost of debt could be much less due to interest payments being tax deductible. The cost of debt after factoring in the tax benefits is called the after-tax cost-of-debt.

https://www.youtube.com/user/Subjectmoney

https://www.youtube.com/watch?v=a7OQE-Oam_M