** Form 990 is available without fees at www.guidestar.org **

The 7 questions to ask when you walk through a nonprofit's US IRS Form 990 documenting the financial results of their activities. Use the “Gear” on the lower right corner of your screen to “speed up” or “slow down” the video. Here are the questions:

Part I. Summary

1. Who is this organization? Confirm that this is the organization you need to review – many have similar names.

2. How big are they? Look at the number of reported employees and volunteers along with financial scale.

3. Are they healthy? Download prior years and look for trends.

Part III. Statement of Program Service Accomplishments

4. What do they really do? Largest programs are described and the direct expenses are stated.

Part IV Checklist of Required Schedules - q. 17-18

5. How do they raise funds? Check boxes identify where additional forms describe their fundraising activities.

Part VII. Compensation

6. Are they professionally managed? Do they rely on Contractors?

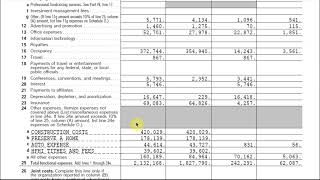

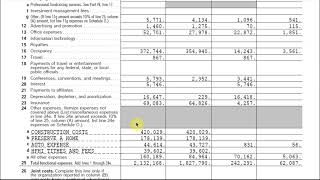

Part IX. Statement of Functional Expenses

7. How do they spend their money? Subjective allocation of detailed expenses by Programs; Mgmt; Fundraising.

Part X. Balance Sheet

[3.] Are they Healthy? – Part 2 – Unrestricted; Temporarily Restricted and Restricted Fund Balances

Schedule A - Public Charity Status and Support

[5.] How do they raise funds - part 2 - last 5 reported years of support

** Form 990 is available without fees at www.guidestar.org **

The 7 questions to ask when you walk through a nonprofit's US IRS Form 990 documenting the financial results of their activities. Use the “Gear” on the lower right corner of your screen to “speed up” or “slow down” the video. Here are the questions:

Part I. Summary

1. Who is this organization? Confirm that this is the organization you need to review – many have similar names.

2. How big are they? Look at the number of reported employees and volunteers along with financial scale.

3. Are they healthy? Download prior years and look for trends.

Part III. Statement of Program Service Accomplishments

4. What do they really do? Largest programs are described and the direct expenses are stated.

Part IV Checklist of Required Schedules - q. 17-18

5. How do they raise funds? Check boxes identify where additional forms describe their fundraising activities.

Part VII. Compensation

6. Are they professionally managed? Do they rely on Contractors?

Part IX. Statement of Functional Expenses

7. How do they spend their money? Subjective allocation of detailed expenses by Programs; Mgmt; Fundraising.

Part X. Balance Sheet

[3.] Are they Healthy? – Part 2 – Unrestricted; Temporarily Restricted and Restricted Fund Balances

Schedule A - Public Charity Status and Support

[5.] How do they raise funds - part 2 - last 5 reported years of support

US IRS Form 990 for Nonprofits: 7 key questions

US IRS Form 990 for Nonprofits: 7 key questions

Category :

Irs Forms