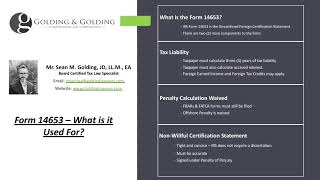

Form 14653: The Form 14653 Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures, is a very important IRS certification form used with the streamlined foreign offshore procedures (SFOP). With SFOP, the taxpayer escapes the entire title 26 miscellaneous offshore penalty -- so a lot is riding on the certification form.Unlike its foreign counterpart Form 14654, the 14653 form does not require the applicant to prepare a penalty computation, which is used in lieu of all the other offshore penalties the IRS can go after a taxpayer for.The form is a part of the streamlined filing procedures. These procedures were developed to help taxpayers avoid the aggressive government enforcement of foreign accounts compliance.Form 14653 While the form 14653 does not require complex penalty calculations or analysis, it does require a certification that the writing is being made under penalty of perjury. Some unethical and inexperienced attorneys try to mislead applicants about this IRS Form, without providing a full understanding of what perjury means.When it comes perjury, it is important to note that it is a crime, punishable by jail or prison. That is not to scare you, but rather to ensure you understand the seriousness of the submission.Let’s take a look at the Form 14653 to provide some more insight on how a U.S. Person Residing Outside of the United States completes the form.Top Section: Personal Information (Form 14653)The top part of the form is relatively simple, and asks only for identifying information:Name

ITIN/Social Security Number

Telephone Number

Mailing Address

City

State Zip Code

Taxes Due (3 Years for Form 14653)The next section is relatively straight forward (at least as to the Taxpayer). It requires information regarding the tax that are due:Year

Amount of Taxes Due

Interest

TotalInterest is actually “estimated” interest, since the exact total amount of interest is not known at the time of submission (varies based on the IRS processing timelines.)What is the Taxpayer Certifying on an IRS Form 14653?The Certification portion short but packed with information. Some of the highlights, include:My failure to report all income, pay all tax, and submit all required information returns, including FBARs, was due to non-willful conduct. I understand that non-willful conduct is conduct that is due to negligence, inadvertence, or mistake or conduct that is the result of a good faith misunderstanding of the requirements of the law.”I acknowledge the possibility that amended income tax returns I am submitting under the Streamlined Foreign Offshore Procedures may report income for tax years beyond the three-year assessment limitations period under I.R.C. § 6501(a).Other assessment limitations periods in I.R.C. § 6501 may allow the Internal Revenue Service to assess and collect tax. If I seek a refund for any tax or interest paid for the omitted income that I am reporting on my amended income tax returns because I feel that my payments were madebeyond the assessment limitations period, I understand that I will forfeit the favorable terms of the Streamlined Procedures. I recognize that if the Internal Revenue Service receives or discovers evidence.IRC 6501 (Limitations on Assessment & Enforcement)The IRS enforcement statute varies from 3-to-6-years, unless civil fraud is involved.(a) General rule Except as otherwise provided in this section, the amount of any tax imposed by this title shall be assessed within 3 years after the return was filed (whether or not such return was filed on or after the date prescribed) or, if the tax is payable by stamp, at any time after such tax became due and before the expiration of 3 years after the date on which any part of such tax was paid, and no proceeding in court without assessment for the collection of such tax shall be begun after the expiration of such period.For purposes of this chapter, the term “return” means the return required to be filed by the taxpayer (and does not include a return of any person from whom the taxpayer has received an item of income, gain, loss, deduction, or credit).(e) Substantial omission of items: Except as otherwise provided in subsection (c)—Income taxes: In the case of any tax imposed by subtitle A— (A)General ruleIf the taxpayer omits from gross income an amount properly includible therein and— (i) such amount is in excess of 25 percent of the amount of gross income stated in the return, or (ii)such amount—(I)is attributable to one or more assets with respect to which information is required to be reported under section 6038D (or would be so required if such section were applied without regard to the dollar threshold specified in subsection

Form 14653: The Form 14653 Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures, is a very important IRS certification form used with the streamlined foreign offshore procedures (SFOP). With SFOP, the taxpayer escapes the entire title 26 miscellaneous offshore penalty -- so a lot is riding on the certification form.Unlike its foreign counterpart Form 14654, the 14653 form does not require the applicant to prepare a penalty computation, which is used in lieu of all the other offshore penalties the IRS can go after a taxpayer for.The form is a part of the streamlined filing procedures. These procedures were developed to help taxpayers avoid the aggressive government enforcement of foreign accounts compliance.Form 14653 While the form 14653 does not require complex penalty calculations or analysis, it does require a certification that the writing is being made under penalty of perjury. Some unethical and inexperienced attorneys try to mislead applicants about this IRS Form, without providing a full understanding of what perjury means.When it comes perjury, it is important to note that it is a crime, punishable by jail or prison. That is not to scare you, but rather to ensure you understand the seriousness of the submission.Let’s take a look at the Form 14653 to provide some more insight on how a U.S. Person Residing Outside of the United States completes the form.Top Section: Personal Information (Form 14653)The top part of the form is relatively simple, and asks only for identifying information:Name

ITIN/Social Security Number

Telephone Number

Mailing Address

City

State Zip Code

Taxes Due (3 Years for Form 14653)The next section is relatively straight forward (at least as to the Taxpayer). It requires information regarding the tax that are due:Year

Amount of Taxes Due

Interest

TotalInterest is actually “estimated” interest, since the exact total amount of interest is not known at the time of submission (varies based on the IRS processing timelines.)What is the Taxpayer Certifying on an IRS Form 14653?The Certification portion short but packed with information. Some of the highlights, include:My failure to report all income, pay all tax, and submit all required information returns, including FBARs, was due to non-willful conduct. I understand that non-willful conduct is conduct that is due to negligence, inadvertence, or mistake or conduct that is the result of a good faith misunderstanding of the requirements of the law.”I acknowledge the possibility that amended income tax returns I am submitting under the Streamlined Foreign Offshore Procedures may report income for tax years beyond the three-year assessment limitations period under I.R.C. § 6501(a).Other assessment limitations periods in I.R.C. § 6501 may allow the Internal Revenue Service to assess and collect tax. If I seek a refund for any tax or interest paid for the omitted income that I am reporting on my amended income tax returns because I feel that my payments were madebeyond the assessment limitations period, I understand that I will forfeit the favorable terms of the Streamlined Procedures. I recognize that if the Internal Revenue Service receives or discovers evidence.IRC 6501 (Limitations on Assessment & Enforcement)The IRS enforcement statute varies from 3-to-6-years, unless civil fraud is involved.(a) General rule Except as otherwise provided in this section, the amount of any tax imposed by this title shall be assessed within 3 years after the return was filed (whether or not such return was filed on or after the date prescribed) or, if the tax is payable by stamp, at any time after such tax became due and before the expiration of 3 years after the date on which any part of such tax was paid, and no proceeding in court without assessment for the collection of such tax shall be begun after the expiration of such period.For purposes of this chapter, the term “return” means the return required to be filed by the taxpayer (and does not include a return of any person from whom the taxpayer has received an item of income, gain, loss, deduction, or credit).(e) Substantial omission of items: Except as otherwise provided in subsection (c)—Income taxes: In the case of any tax imposed by subtitle A— (A)General ruleIf the taxpayer omits from gross income an amount properly includible therein and— (i) such amount is in excess of 25 percent of the amount of gross income stated in the return, or (ii)such amount—(I)is attributable to one or more assets with respect to which information is required to be reported under section 6038D (or would be so required if such section were applied without regard to the dollar threshold specified in subsection

Form 14653: IRS Certification by US Person Residing Outside of the United States (Foreign Resident)

Form 14653: IRS Certification by US Person Residing Outside of the United States (Foreign Resident)

Category :

Irs Forms