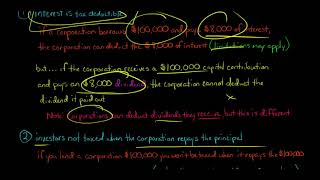

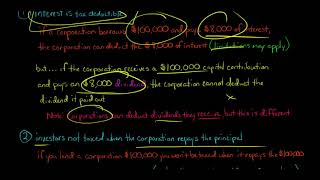

< iframe width="480" height="320" src="https://www.youtube.com/embed/oQp5yJ_ZTcc?rel=0" frameborder="0" allowfullscreen >< img style="float: left; margin:0 5px 5px 0;" src="http://ustaxreview.org/wp-content/uploads/2021/03/rVNip1.jpg"/ > When choosing how to fund a corporation, there are advantages to using debt rather of equity.

The most important benefit of using financial obligation is that interest sustained on the financial obligation is tax deductible for the corporation. Dividends paid to investors, on the other hand, are not tax deductible for the corporation.

--.

Edspira is the production of Michael McLaughlin, who went from teenage homelessness to a PhD.

Edspira's mission is to make a premium company education accessible to all individuals.

--.

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS & OTHER FREE GUIDES.

* http://eepurl.com/dIaa5z.

--.

MICHAEL'S STORY.

* https://www.edspira.com/about/.

--.

LISTEN TO THE PLAN PODCAST.

* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725.

* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc.

* Site: https://www.edspira.com/podcast-2/.

--.

GET IN TOUCH WITH EDSPIRA.

* Website: https://www.edspira.com.

* Instagram: https://www.instagram.com/edspiradotcom.

* LinkedIn: https://www.linkedin.com/company/edspira.

* Facebook: https://www.facebook.com/Edspira.

* Reddit: https://www.reddit.com/r/edspira.

* TikTok: https://www.tiktok.com/@edspira.

--.

GET IN TOUCH WITH MICHAEL.

* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin.

* Twitter: https://www.twitter.com/Prof_McLaughlin.

* Instagram: https://www.instagram.com/prof_mclaughlin.

* Snapchat: https://www.snapchat.com/add/prof_mclaughlin.

* TikTok: https://www.tiktok.com/@prof_mclaughlin.

--.

EMPLOY MCLAUGHLIN Certified Public Accountant.

* Site: http://www.MichaelMcLaughlin.com/hire-me

< iframe width="480" height="320" src="https://www.youtube.com/embed/oQp5yJ_ZTcc?rel=0" frameborder="0" allowfullscreen >< img style="float: left; margin:0 5px 5px 0;" src="http://ustaxreview.org/wp-content/uploads/2021/03/rVNip1.jpg"/ > When choosing how to fund a corporation, there are advantages to using debt rather of equity.

The most important benefit of using financial obligation is that interest sustained on the financial obligation is tax deductible for the corporation. Dividends paid to investors, on the other hand, are not tax deductible for the corporation.

--.

Edspira is the production of Michael McLaughlin, who went from teenage homelessness to a PhD.

Edspira's mission is to make a premium company education accessible to all individuals.

--.

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS & OTHER FREE GUIDES.

* http://eepurl.com/dIaa5z.

--.

MICHAEL'S STORY.

* https://www.edspira.com/about/.

--.

LISTEN TO THE PLAN PODCAST.

* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725.

* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc.

* Site: https://www.edspira.com/podcast-2/.

--.

GET IN TOUCH WITH EDSPIRA.

* Website: https://www.edspira.com.

* Instagram: https://www.instagram.com/edspiradotcom.

* LinkedIn: https://www.linkedin.com/company/edspira.

* Facebook: https://www.facebook.com/Edspira.

* Reddit: https://www.reddit.com/r/edspira.

* TikTok: https://www.tiktok.com/@edspira.

--.

GET IN TOUCH WITH MICHAEL.

* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin.

* Twitter: https://www.twitter.com/Prof_McLaughlin.

* Instagram: https://www.instagram.com/prof_mclaughlin.

* Snapchat: https://www.snapchat.com/add/prof_mclaughlin.

* TikTok: https://www.tiktok.com/@prof_mclaughlin.

--.

EMPLOY MCLAUGHLIN Certified Public Accountant.

* Site: http://www.MichaelMcLaughlin.com/hire-me

3 Tax Advantages of Debt (U.S. Corporate Tax)

3 Tax Advantages of Debt (U.S. Business Tax)

Category :

Tax Lawyer News