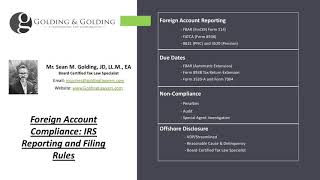

Which IRS Forms Used to Report Offshore Accounts & Assets

Which IRS Forms Used to Report Offshore Accounts & Assets

Which IRS Forms Used to Report Offshore Accounts & Assets

International Tax Lawyers | IRS Offshore DisclosureU.S. Tax of Foreign Income Explained U.S. Tax of Foreign Income: The United States is one of the few countries in the world that follows a worldwide income tax and reporting model. This means that U.S. Persons are subject to tax on their worldwide income, and must report their global assets to the IRS each year on a myriad of different international information reporting forms. To be a considered a U.S. person (Individual), there are three main categories: U.S. Citizen Legal Permanent Resident Foreign National who meets the Substantial Presence Test (SPT) We will summarize the U.S. Tax of Foreign Income tax and IRS reporting requirements.