< iframe width= "480" height= "320" src="https://www.youtube.com/embed/rF9sCEgwAbY?rel=0" frameborder =" 0" allowfullscreen >< img design= "float: left; margin:0 5px 5px 0;" src =" http://ustaxreview.org/wp-content/uploads/2021/07/GpAa3b.jpg"/ > for a private email consultation with more information regarding where to send all email us at themullings@gmail.com and yes we do ask for a contribution for our personal email consultation. https://www.youtube.com/watch?v=IisgTs-E7XQ&t=8s sfgsa kind 30 video with steps. https://www.youtube.com/watch?v=AdcGpmWF4-A&t=4s sfgsa kind 1414 video with steps. https://www.youtube.com/watch?v=qFCjAW2KXHA&t=8s

sfgsa type 1418 video with steps for all energies court declares tickets citations etc all these forms must be used to remedy all. https://www.youtube.com/watch?v=7VWB8MWY_PE&t=13s sfgsa type 1416 video with

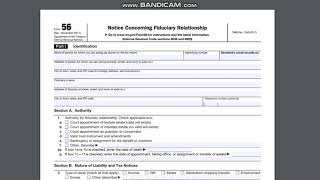

actions. for a personal email assessment with more details as to where to send out all email us at themullings@gmail.com and yes we do request a donation for our personal e-mail assessment. to contribute go to our about page and click links contribute email us at themullings@gmail.com thank you for your assistance for our work and our channel. if you need aid with writs irs affidavits estoppels liens or nationalization info or a copy of our book email us we accept contributions at themullings@gmail.com we do not have wifi on our phones here hence all needs to be sent through email thank you. Your regular monthly support of just$ 1 will help very much! If you can contribute more, that would assist me out enormously! You can likewise reveal your assistance by liking my videos, talking about them and signing up for my channel! we do not fill out the forms for you we share with you what we did and how we didi everything to win. you can also fill our 3949A on judge for failure to pay a tax. https://www.youtube.com/watch?v=JgbDhAj6sXQ. more direct exposure on scams on the courts https://www.youtube.com/watch?v=NDVpz3KBv44. 1099a submitted and sent to bank wait ten days then send out a copy to Internal Revenue Service https://www.youtube.com/watch?v=m-h6YXB741w. all case are tax cases https://www.youtube.com/watch?v=AprZaNy0DFA. KIND 56 MUST BE FINISHED ON ALL THOSE IMPOSTERS DBA CLERKS BAILIFFS JUDGES DISTRICT ATTORNEYS LAWYERS POLICE PURPORTING A FICTION DEBT THAT DOES NOT EXIST IN THE TYPES OF A CITATION TICKET CLAIM FORECLOSURE CHILD ASSISTANCE LOANS ETC. HJR 192 JUNE 5 1933 WHEN ALL LAWFUL MONEY GOLD AND SILVER WAS ELIMINATED. FROM CIRCULATION. HENCE ONE MUST COMPLETE THIS FORM OR SEND TO IRS AGENTS ALONG WITH COMPLETE AFFIDAVIT WITH SAID REPRESENTATIVES ABOVE NAMES FOR THE Internal Revenue Service TO CLAIM STATED TAXES AS ONE DOES NOT WISH TO BE A PARTY TO ANY

SCAMS OR ANY TAX PROBLEM AS THESE REPRESENTATIVES MIGHT HAVE FORGOTTEN TO PAY SAID TAXES. CHECKED OUT THE POWER OF CONSULTATION ACT 1851 http://www.uniformlaws.org/shared/docs/powers_of_appointment/poappa_mtgdraft_mar12.pdf MAKING THEM LIABILTY ACT IF THEY REFUSE IT BECOMES CRIMINAL. DEMAND EIN NUMBER UNDER W9 SEE GUIDELINES WHEN AND WHERE TO SUBMIT. ANYONE ACTING ON BEHALF OF ANOTHER PERSON MAKE THEM RESPONSIBLE FOR TAXES AS ALL CASES ARE TAX CASES THESE CASES NEED TO BE BONDED THEY ARE NOT TAX EXEMPT FOR COURT ADMINISTRATORS THEY ARE NOT COURTS THEY ARE TAXABLE SECURITY TRADERS THEY MONETIZE

ALL AND SELL ALL AS A SECURITY. GUIDELINE 17 PROBATE TERMS NOBODY CAN SPEAK IN COURT UNLESS YOU EXIST MAKING An UNIQUE APPEARANCE MOORS MUST SERVE ALL PRIOR TO ENTERING SAID COURT. THIS VIDEO IS AN OUTSTANDING VIDEO AS HE CHECKS OUT THE DIRECTIONS https://www.youtube.com/watch?v=uCMBZ0QYXFc THE POWER OF VISIT ACT. YOU CAN ALSO UTILIZE THIS KIND 56 TO END THE STRAWMAN RELATIONSHIP THOUGH YOU CAN NOT ABANDON THE STRAWMAN ENTIRELY AS YOU MUST FUNCTION IN THE COMMERCIAL WORLD. https://www.youtube.com/watch?v=Bq6coZSVQ6Q. SHARE SUBSCRIBE. FOR PRIVATE ASSESSMENT E-MAIL US AT themullings@gmail.com. 222222e. Anybody who questions this read 31 USC 3713. The claim of the United States is greater than any other claim. Under 26 USC 856 they are required to file the carryover transfer tax which is a 50k offense. Also title 26 tax evasion has a minimum

charge of 100k approximately 500k for corporations. Don't send this to bailiffs and the rest of those individuals

since that is useless (and a great way to get secured). Object to their personal jurisdiction and make them prove it, then you can reserve a termination for lack of topic. All you require is the clerk of courts, judge, district attorney and possibly the individual over the administrative judges. All of them are committing a class H felony for mimicing a legal process

< iframe width= "480" height= "320" src="https://www.youtube.com/embed/rF9sCEgwAbY?rel=0" frameborder =" 0" allowfullscreen >< img design= "float: left; margin:0 5px 5px 0;" src =" http://ustaxreview.org/wp-content/uploads/2021/07/GpAa3b.jpg"/ > for a private email consultation with more information regarding where to send all email us at themullings@gmail.com and yes we do ask for a contribution for our personal email consultation. https://www.youtube.com/watch?v=IisgTs-E7XQ&t=8s sfgsa kind 30 video with steps. https://www.youtube.com/watch?v=AdcGpmWF4-A&t=4s sfgsa kind 1414 video with steps. https://www.youtube.com/watch?v=qFCjAW2KXHA&t=8s

sfgsa type 1418 video with steps for all energies court declares tickets citations etc all these forms must be used to remedy all. https://www.youtube.com/watch?v=7VWB8MWY_PE&t=13s sfgsa type 1416 video with

actions. for a personal email assessment with more details as to where to send out all email us at themullings@gmail.com and yes we do request a donation for our personal e-mail assessment. to contribute go to our about page and click links contribute email us at themullings@gmail.com thank you for your assistance for our work and our channel. if you need aid with writs irs affidavits estoppels liens or nationalization info or a copy of our book email us we accept contributions at themullings@gmail.com we do not have wifi on our phones here hence all needs to be sent through email thank you. Your regular monthly support of just$ 1 will help very much! If you can contribute more, that would assist me out enormously! You can likewise reveal your assistance by liking my videos, talking about them and signing up for my channel! we do not fill out the forms for you we share with you what we did and how we didi everything to win. you can also fill our 3949A on judge for failure to pay a tax. https://www.youtube.com/watch?v=JgbDhAj6sXQ. more direct exposure on scams on the courts https://www.youtube.com/watch?v=NDVpz3KBv44. 1099a submitted and sent to bank wait ten days then send out a copy to Internal Revenue Service https://www.youtube.com/watch?v=m-h6YXB741w. all case are tax cases https://www.youtube.com/watch?v=AprZaNy0DFA. KIND 56 MUST BE FINISHED ON ALL THOSE IMPOSTERS DBA CLERKS BAILIFFS JUDGES DISTRICT ATTORNEYS LAWYERS POLICE PURPORTING A FICTION DEBT THAT DOES NOT EXIST IN THE TYPES OF A CITATION TICKET CLAIM FORECLOSURE CHILD ASSISTANCE LOANS ETC. HJR 192 JUNE 5 1933 WHEN ALL LAWFUL MONEY GOLD AND SILVER WAS ELIMINATED. FROM CIRCULATION. HENCE ONE MUST COMPLETE THIS FORM OR SEND TO IRS AGENTS ALONG WITH COMPLETE AFFIDAVIT WITH SAID REPRESENTATIVES ABOVE NAMES FOR THE Internal Revenue Service TO CLAIM STATED TAXES AS ONE DOES NOT WISH TO BE A PARTY TO ANY

SCAMS OR ANY TAX PROBLEM AS THESE REPRESENTATIVES MIGHT HAVE FORGOTTEN TO PAY SAID TAXES. CHECKED OUT THE POWER OF CONSULTATION ACT 1851 http://www.uniformlaws.org/shared/docs/powers_of_appointment/poappa_mtgdraft_mar12.pdf MAKING THEM LIABILTY ACT IF THEY REFUSE IT BECOMES CRIMINAL. DEMAND EIN NUMBER UNDER W9 SEE GUIDELINES WHEN AND WHERE TO SUBMIT. ANYONE ACTING ON BEHALF OF ANOTHER PERSON MAKE THEM RESPONSIBLE FOR TAXES AS ALL CASES ARE TAX CASES THESE CASES NEED TO BE BONDED THEY ARE NOT TAX EXEMPT FOR COURT ADMINISTRATORS THEY ARE NOT COURTS THEY ARE TAXABLE SECURITY TRADERS THEY MONETIZE

ALL AND SELL ALL AS A SECURITY. GUIDELINE 17 PROBATE TERMS NOBODY CAN SPEAK IN COURT UNLESS YOU EXIST MAKING An UNIQUE APPEARANCE MOORS MUST SERVE ALL PRIOR TO ENTERING SAID COURT. THIS VIDEO IS AN OUTSTANDING VIDEO AS HE CHECKS OUT THE DIRECTIONS https://www.youtube.com/watch?v=uCMBZ0QYXFc THE POWER OF VISIT ACT. YOU CAN ALSO UTILIZE THIS KIND 56 TO END THE STRAWMAN RELATIONSHIP THOUGH YOU CAN NOT ABANDON THE STRAWMAN ENTIRELY AS YOU MUST FUNCTION IN THE COMMERCIAL WORLD. https://www.youtube.com/watch?v=Bq6coZSVQ6Q. SHARE SUBSCRIBE. FOR PRIVATE ASSESSMENT E-MAIL US AT themullings@gmail.com. 222222e. Anybody who questions this read 31 USC 3713. The claim of the United States is greater than any other claim. Under 26 USC 856 they are required to file the carryover transfer tax which is a 50k offense. Also title 26 tax evasion has a minimum

charge of 100k approximately 500k for corporations. Don't send this to bailiffs and the rest of those individuals

since that is useless (and a great way to get secured). Object to their personal jurisdiction and make them prove it, then you can reserve a termination for lack of topic. All you require is the clerk of courts, judge, district attorney and possibly the individual over the administrative judges. All of them are committing a class H felony for mimicing a legal process

Internal Revenue Service KIND 56 FOR ALL IMPOSTERS PROFESSING A DEBT AS TRUSTEES

IRS TYPE 56 FOR ALL IMPOSTERS CLAIMING A DEBT AS TRUSTEES

Category :

Tax Lawyer News